The end of the year can be quite a daunting time that may overwhelm many small business owners. Taxes can be scary because, if not done properly, they can bring unwanted attention from the IRS. And, truly, ain’t nobody got time for that. In this case, an ounce of preparation can be worth a metric ton of cure. Here at Accountingprose, organized preparation happens to be one of our core superpowers.

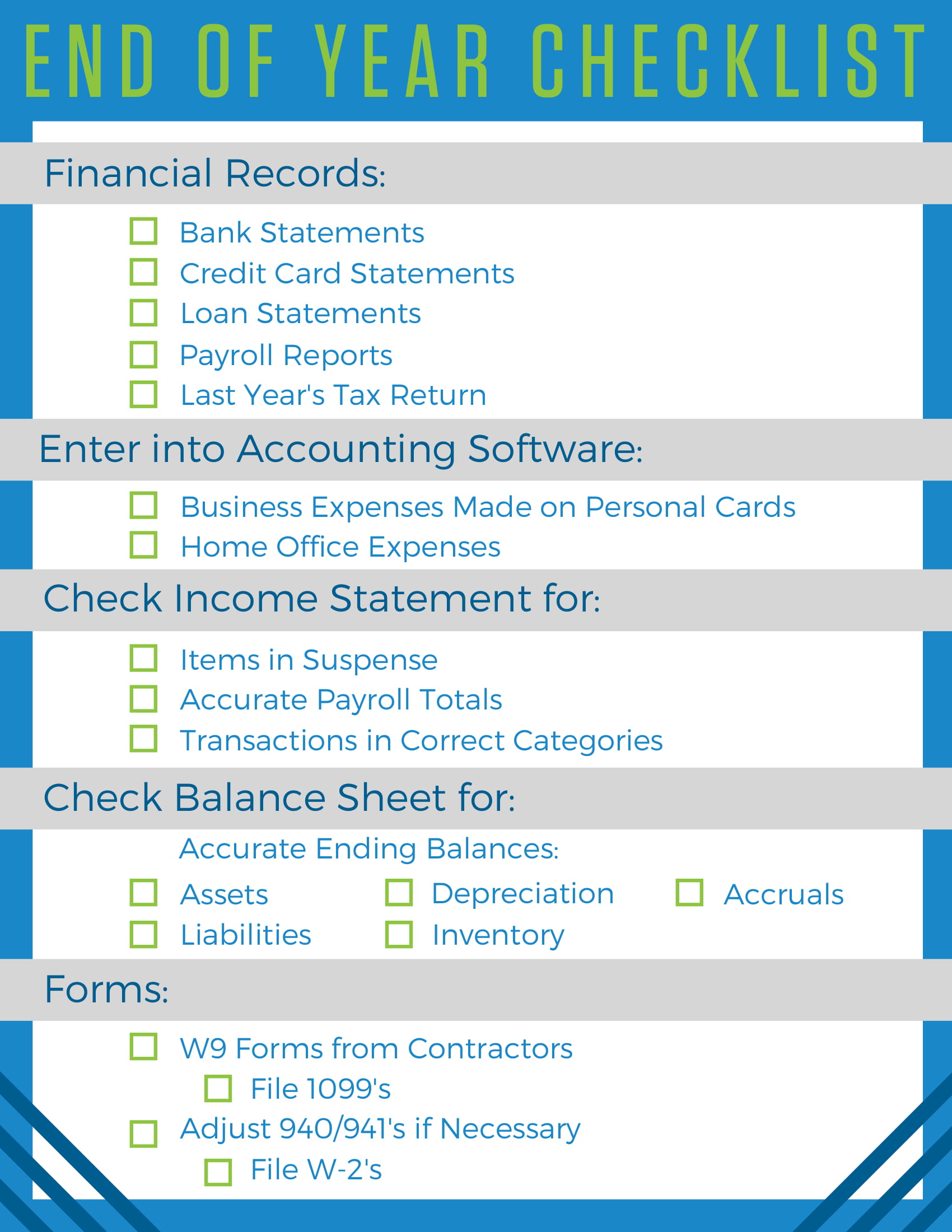

Using the handy-dandy checklist below will ensure the smoothest possible year-end filing.

Be sure to make it to the bottom for a downloadable checklist!

When reviewing a Xero file at the end of the year, here’s what to look for:

Financial Statements to Collect-

Before starting, it’s important to keep a digital or paper copy (or both) of the following documents on hand. They’ll come in handy should there be any uncertainty as to when or why a transaction appeared in the Xero file.

- Bank Statements

- Credit Card Statements

- Interest Statements

- Payroll Reports

- Previous Year’s Tax Return

Income Statement

The Income Statement (or Profit and Loss) is very important when filing taxes! Its contents essentially decide the final number on which taxes are paid, what deductions are available, and how much, if anything, the business ends up owing Uncle Sam for 2017. It’s critical to make sure that all revenue and expenses are accounted for so that Net Income or Loss is completely accurate.

Remember to review the following:

- Are there any items in Suspense/Ask My Accountant? These are unidentified transactions that need a home! Make sure they’re all cleared out and in their correct account. Properly placing them will paint an accurate picture of the company’s financials at year end.

- Are payroll totals accurate? (Huge IRS red flag). The IRS thrives on knowing how much money everyone makes, down to the penny. Review all 940/941 payments to make sure that no adjustments need to be made– or have been made, but are not yet accounted for in Xero. The numbers reported to the IRS at the end of the year when filing W-2s should match exactly what was reported on the 940/941s throughout the year. If needed, submitting an adjusted 940/941 is easy to do [much easier, it can’t be overstated, than dealing with getting it wrong!].

- Are all transactions properly categorized? Even though items in suspense might be cleared out, it’s a good idea to check over all accounts and make sure there aren’t any transactions categorized incorrectly. This will ensure an accurate picture for potential deductions and help to avoid any red flags.

- Were any business expenses made on personal cards? This is something that can easily slip through the cracks without being noticed. The best way to take care of these expenses is to enter them as they happen through the year while they’re fresh in mind. Things happen, and sometimes we forget. Double checking personal accounts will give peace of mind that an honest mistake won’t cause unwelcome attention. If any transactions did get missed, entering them into Xero for the date they appear on the personal statement will bring things to where they need to be.

- Are there any home office expenses? Expenses for maintaining a home office count as business expenses! It’s even possible to portion out rent or mortgage, as well as utilities, and expense them through the business.

Balance Sheet Items

The Balance Sheet at of the end of the year shows a quick snapshot of the business. It highlights what is owned and what is owed. This won’t factor as heavily into what gets filed on the tax return, but it’s still important for it to be accurate going into the new year. Many items on the balance sheet might need to updated or adjusted manually.

Check each ending balance. Do the account balances seem too low or high? Check into any transactions that may be inaccurate!

- Assets: These are things that you own, like bank accounts, fixed asset (cars, heavy equipment) and inventory. Check the ending inventory for the year. Take an inventory count (if there is any) and make adjustments as needed. This is very important to do every year, even when using a perpetual inventory system that tracks what’s coming and going in and out of the company. Mistakes happen! Double checking with a physical inventory every year will spot these mistakes before it’s too late.

- Liabilities: These are things that you owe. Look at your credit and loan balances and be sure that your statements match your accounting software.

- Depreciation: This needs to be adjusted manually by creating an entry with Accumulated Depreciation and Depreciation Expense. This expense can make a huge difference on net profit which translates to how much is owed in taxes.

- Payroll (and other) accruals: These are liabilities owed to employees or vendors for work done in 2017 but yet to be paid for by 2018. Adding these in keeps all 2017 expenses in 2017 where they belong, rather than in 2018 when they might be paid out.

Forms to File

- Do you have W9s on file for all contractors? This form includes all of the information for vendors so that their 1099 can be filed completely and correctly. Ready to file 1099s? When all pertinent information for relevant vendor(s) is in hand, it’s time to file their 1099 form. The vendor and the IRS must get a copy by January 31, 2018.

- Do any adjustments need to be made to the 940/941s filed during the year? These are the reports filed throughout the year reporting employees’ wages. Be sure to file amended returns if you see any errors.

- Ready to file those W-2s? Once payroll totals are confirmed and all employees’ information (gathered from the W-4 filled out when hired) is assembled, it’s time to issue their W-2s. Send two copies to the employee as well as a copy to the Social Security Administration by January 31, 2018.

Check the Budget in Xero

Already have a budget ready to go in Xero? If not, this year is the year to start! Looking back at the budget at the end of the year when all numbers are in is a major key to making sure the business is running smoothly! It’s also great for setting goals and ensuring attention is being paid to what’s happening every month and year.

- Review the year by comparing actual totals to the budget.

- How did this year compare to prior years?

- Think ahead to what could change or improve in the upcoming year

Things to do at the beginning of the new year (aside from filing taxes):

Already have a budget ready to go in Xero? If not, this year is the year to start! Looking back at the budget at the end of the year when all numbers are in is a major key to making sure the business is running smoothly! It’s also great for setting goals and ensuring attention is being paid to what’s happening every month and year.

- Check whether any payroll rates have changed. Verify that your payroll reflects the most current unemployment rate and that your pay is in line with current minimum wage law.

- Work on a fresh budget using last year’s numbers. Clean things up and get on track

- Make sure the employee list is up-to-date

- Update service account passwords and who has access to them

- Update any changed policies and procedures

- Reorganize files and email inbox (groan, we know)

- Fill out a business calendar. Add in due dates for bills and taxes so that you don’t fall behind.

- Set some goals!

Completing the above checklist will prepare you to file for 2017 and jump start your 2018 so that the end of year isn’t so scary the next time around!

We made a downloadable and printable End of Year Checklist to keep you on track! To see all the tasks without all the words, download it and get them all crossed off!